Cheyenne Credit Unions: Discover the Best Local Banking Services

Cheyenne Credit Unions: Discover the Best Local Banking Services

Blog Article

Unlock the Benefits of a Federal Cooperative Credit Union Today

Explore the untapped advantages of straightening with a federal lending institution, a strategic financial step that can reinvent your financial experience. From special participant rewards to a strong community principles, government credit score unions use an unique strategy to financial services that is both financially useful and customer-centric. Discover how this different financial version can supply you with a special viewpoint on financial wellness and lasting stability.

Advantages of Joining a Federal Credit Union

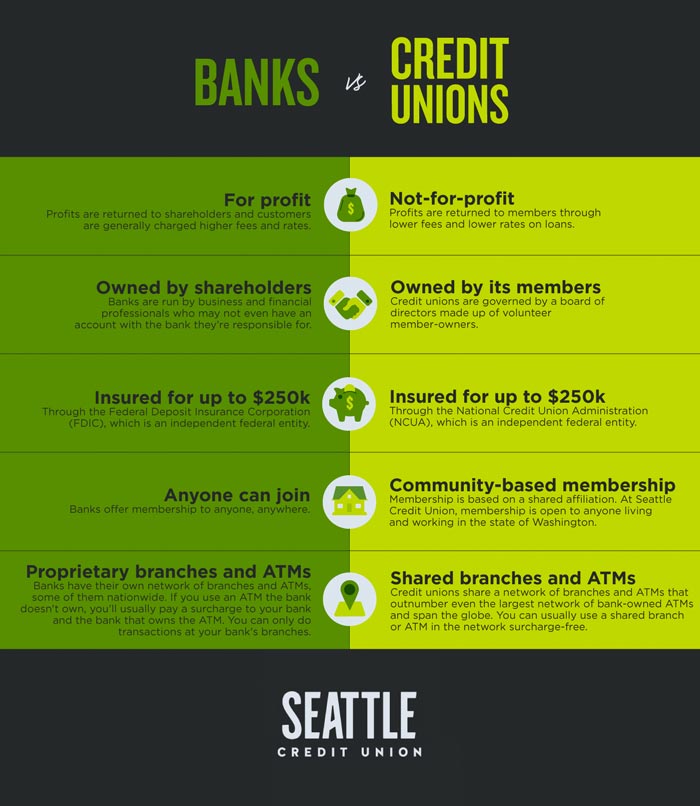

One of the primary benefits of joining a Federal Credit report Union is the focus on member satisfaction rather than creating profits for investors. In Addition, Federal Credit history Unions are not-for-profit organizations, permitting them to use competitive interest prices on financial savings accounts, fundings, and credit rating cards (Wyoming Federal Credit Union).

Another benefit of joining a Federal Lending institution is the feeling of neighborhood and belonging that participants usually experience. Credit report Unions are member-owned and operated, indicating that each participant has a risk in the organization. This can cultivate a feeling of commitment and trust in between participants and the Cooperative credit union, causing a more tailored banking experience. Federal Credit history Unions typically offer economic education and sources to help members boost their economic literacy and make informed decisions about their cash.

Lower Charges and Competitive Prices

In addition, federal credit history unions are known for supplying competitive passion prices on cost savings accounts, loans, and credit score cards. By providing these competitive prices, government credit score unions prioritize the economic well-being of their participants and make every effort to assist them achieve their economic goals.

Personalized Client Service

A hallmark of government cooperative credit union is their devotion to offering tailored customer care tailored to the specific demands and preferences of their members. Unlike standard banks, federal lending institution prioritize developing solid relationships with their members, aiming to provide a much more customized experience. This personalized approach suggests that participants are not just viewed as an account number, yet rather as valued individuals with distinct monetary goals and scenarios.

One method federal cooperative credit union provide customized customer care is with their member-focused method. Representatives make the effort to comprehend each participant's particular monetary scenario and deal tailored solutions to meet their demands. Whether a participant is looking to open up a new account, get a loan, or look for economic guidance, government lending institution strive to give customized guidance and support every action of the method.

Community-Focused Efforts

To additionally improve their effect and connection with members, government lending institution actively take part in community-focused initiatives that add to the well-being and growth of the areas they offer. These efforts typically consist of monetary education and learning programs targeted at encouraging individuals with the understanding and skills to make educated decisions concerning their finances (Credit Unions Cheyenne WY). By supplying workshops, workshops, and one-on-one therapy sessions, credit unions assist area members boost their monetary proficiency, manage financial obligation efficiently, and plan for a safe future

Additionally, government credit unions often join neighborhood occasions, sponsor community projects, and support charitable causes to resolve specific demands within their service locations. This participation not only shows their commitment to social responsibility but additionally enhances their connections with members and fosters a sense of belonging within the neighborhood.

Via these community-focused initiatives, federal lending institution play an essential role in advertising economic inclusion, financial stability, and overall success in the areas they operate, eventually developing a positive effect that expands past their conventional banking services.

Optimizing Your Membership Benefits

When seeking to take advantage of your membership advantages at a credit report union, understanding the range of resources and solutions offered can considerably improve your monetary wellness. Federal cooperative credit union supply a series of benefits to their participants, consisting of competitive rate of interest on savings accounts and loans, lower costs compared to typical banks, and personalized client service. By making the most of these advantages, participants can enhance their financial security and accomplish their goals more properly.

Additionally, participating in economic education programs and workshops offered by the credit union can aid you enhance your money monitoring skills and make more educated decisions concerning your economic future. By actively involving with the resources offered to you as a participant, you can open the More Info full potential of your partnership with the credit history union.

Final Thought

To conclude, the benefits of signing up with a government credit scores union include lower charges, competitive rates, individualized consumer service, and community-focused initiatives. By maximizing your membership advantages, you can access expense savings, customized services, and a sense of belonging. Think about opening the advantages of a federal credit rating union today to experience a financial institution that prioritizes member More hints complete satisfaction and supplies a series of resources for monetary education.

In Addition, Federal Credit rating Unions are not-for-profit companies, enabling them to offer affordable passion prices on cost savings accounts, fundings, and credit history cards.

Federal Credit report Unions typically go to the website give financial education and learning and resources to assist members enhance their monetary proficiency and make notified choices concerning their cash.

Report this page